Complimentary insurance covers available on HDFC Bank | State Bank of India | ICICI Bank | Axis Bank | Kotak Mahindra Bank | IndusInd Bank | Yes Bank | Punjab National Bank | Bank Of Baroda | Bank Of India | and all other banks

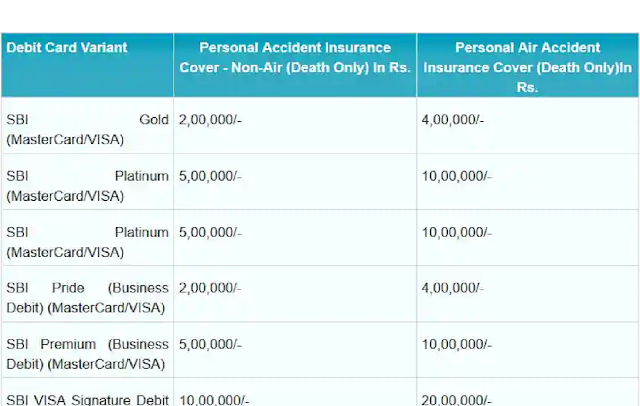

COMPLIMENTARY INSURANCE COVERS AVAILABLE ON SBI DEBIT CARDS

Personal Accidental Insurance (Death) Non Air: This insurance covering the Debit Cardholder for non-air accidental death only, to the range as joined on the type of Debit Card difference held. This Insurance Cover becomes working when the Card is used at least once on any channel, viz ATM/PoS/eCom all over the last 90 days (Financial) from the date of accident

(Financial transaction) from the date of accident, subject to a order that the air ticket for that air travel must have been get by using the Debit Card

How to claim the insurance cover?

In sample of any declare, the claimant should tell ICICI Lombard call centre on 1800 2666, within 15 days of loss or damage.

ICICI Lombard will tell the applicant about the documents nedded for processing the claim.

The claimant should forwards the necessary documents to ICICI Lombard.

The Customer Service branch of ICICI Lombard will decide on the connection of any claim as per the Terms & Conditions of the policy, after taking the documents and inquiry report, if connected.

On admissibility, ICICI Lombard will make the payment to the voucher. The payment must be made within 15 working days of voucher of all complete documents, in case an inquiry is not necessary.

Bank of India Debit Card

Disbenefit card has remade the face of Indian economy, it's designate as the plastic card. It has been a pivotal organizer for cashless agreement in the economy. Disbenefit cards have authorize the cardholder to lighten the carryall. Disbenefit cards are give by banks in relationship with Visa or Mastercard. They are issued as part of the account opening attack to the account holder. There are different types of disbenefit cards give by the bank, controlled on the limit and felicity, an eligible account holder may choose the right disbenefit card.

What is a debit card?

A disbenefit card is also introduce to as plastic card or check card. It can be used at various points of trade involve petrol pump, dealer outlets (online and offline), payment of availbillsetc., It's similar to that of credit card, still, in credit card, the bank authorize the card holder to use the card at points of trade without actually holding as important cash in the account with the bank, it's an order where the bank allows the cardholder to strike the card at outlets by offering a short- term credit or loan. The card holder will be necessary to make the payment in the following billing cycle. The disbenefit card is like apre- paid card, wherefore the card is associate to savings bank account, the card can be swiped predicated on fund vacuity in the savings bank accounts.

Some banks now offer insurance collection with the plain humble fixed deposit (FD). HDFC Bank has rotate out a new FD plan known as ‘SureCover’ in the month of March 2021. The FD plan comes with a completed life insurance cover. The insurance policy will be present by HDFC Life Insurance. HDFC Bank will accept the instalment cost of the term life cover for one year, on deposits of Rs 2 lakh to Rs 10 lakh.

ICICI Bank and DCB Bank previously offer similar FD plan. Should you take the bait of investing in such FD plan with additional life insurance cover?

All investing between Rs 2 lakh and Rs 10 lakh, generate in HDFC Bank’s SureCover FD plan for occupation of more than a year and up to 10 years will come with a glowing term life insurance cover. The life cover is euqal to the FD’s principal value. The commendatory life insurance profit is only for the first year of the FD ownership and will expire after that. If during the first year of the FD, if there is an unlucky even of temporality, your nominees / beneficiaries will get a lump-sum equivalent to FD amount. You can hold only one SureCover FD at any content in time. Existing and new HDFC Bank customers can finance in this plan.

ICICI Bank provide a flat Rs 3 lakh term life cover on deposits of Rs 3 lakh or more via the ‘FD Life’ plan. The occupation of FD should be minimum two years. The supporting life insurance profit is only for the first year of the FD owenrship.

DCB Bank’s ‘Suraksha FD’ gives you a term life cover for up to Rs 50 lakh. The life cover is equal to the FD’s principal value. The investment period is necessary three years and life insurance cover is obtainable for the three-year term.